Over 70% of customers from the four largest US banks use mobile banking apps. One in five people in the United States uses banking apps in general.

Mobile banking app development is quite a promising FinTech industry for today:

It’s customer experience and convenience that stands behind the success of mobile banking. You can’t make a competitive app without brilliant interface, simple and understandable interactions, and thought-out features.

In this guide, we’re explaining the basics of banking app development, its pros and cons, and the main challenges you’re going to face.

The advantages of banking app development go both ways:

Let’s take a closer look at the top benefits for business.

Mobile apps save banks a lot of money. Here’s how:

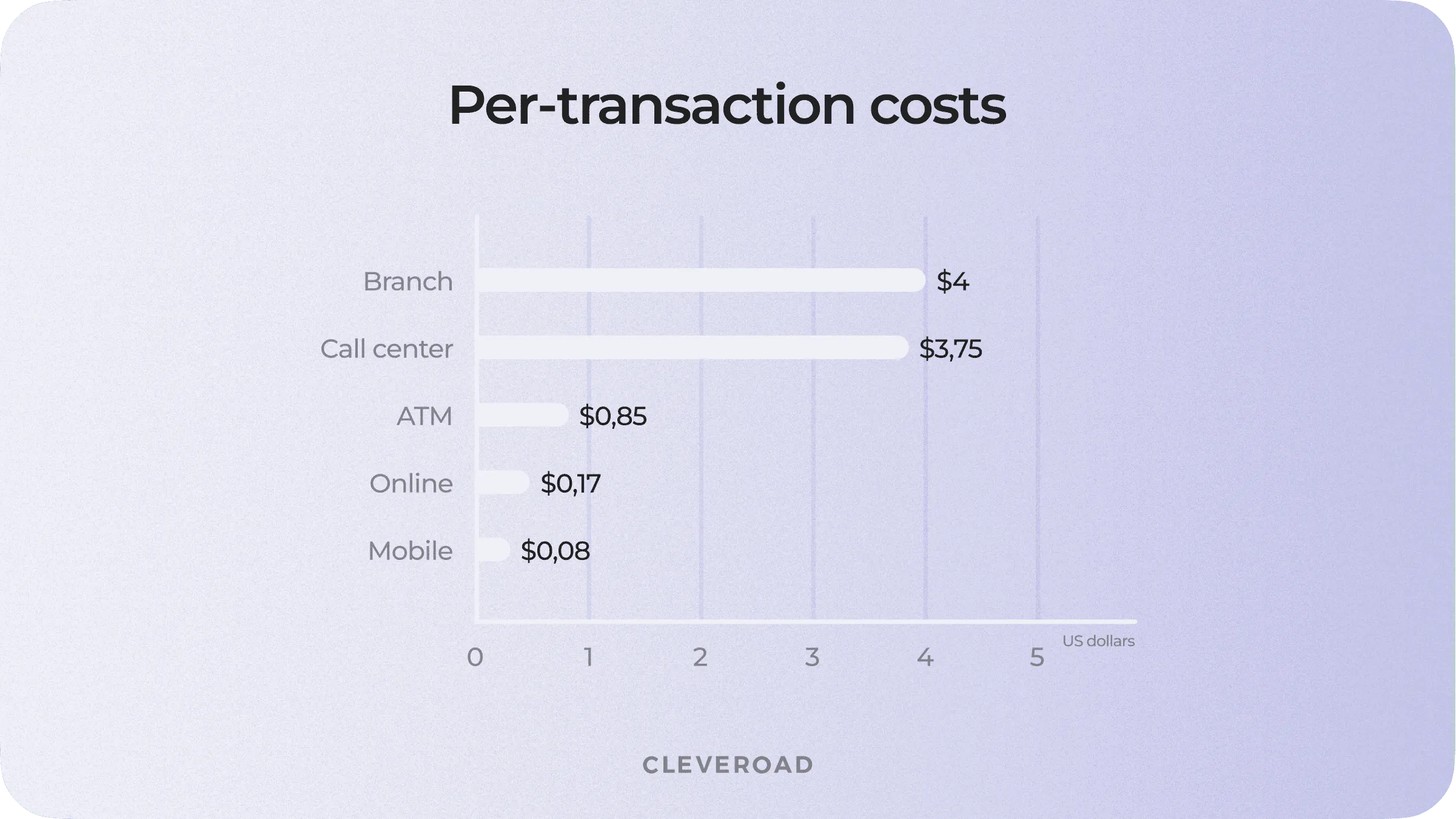

For example, mobile transactions are ten times cheaper than ATM transactions, only 0.08 cents per each . Compared to 0.85 cents for an ATM transaction and $4.00 for a branch one.

Per-transaction cost by banking channel

The exact cost of banking mobile app development always depends on the platform, features, and UI/UX design. But there’s one thing for sure: software development costs a lot. So it’s natural that banks would love to return these expenses.

We have a guide listing the average software development cost and the factors that affect it.

There are several ways how mobile banking returns investments—people make transactions more often and become more engaged.

Bank of Ann Arbor, a $1.2 billion community bank in Michigan, managed to return the money they invested in a solution for mobile banking. Within three months of adopting mobile banking, they saw:

There was also an increase in customer loyalty. The bank made a survey, finding out that app customers were 2 points less likely to leave the bank than online banking customers. And nearly 8 points less likely to leave than branch-only clients.

Patti Judson

EVP and COO at Bank of Ann Arbor

We weren’t surprised at the profitability; we expected it to be more profitable. What did surprise was the outcome and adoption of our customers…more engaged customers with more products. This gives us multiple reasons to sell mobile

Mobile apps just offer more benefits to customers. They're more secure and more convenient: you can't use fingerprint login with a chatbot or carry a PC in your pocket. One-third of banking app users say that mobile experience is why they stay with their current bank. Morover, mobile banking app development provides on-the-go 24/7 access to all the financial services. Constant accessibility saves you time. For example, you can check deposits, view recent transactions, make bill payments, etc., whether at home or while traveling.

Explore how you can benefit from creating a finance app

Whether you're introducing a new insurance package, increased credit limit, or new in-app features, you can notify customers about it right in the app. Most banking apps use personal dashboard, messages, or send push notifications. Consequently, users are comfortable with getting well-timed relevant information. For instance, at BNP Paribas saw a 60% increase in App Store rating (from a 2.5 rating to 4 stars) after they added targeted push notifications.

Push notifications with promotions in Revolut app (as an example)

The main challenge of mobile banking application development is connected with security. There are multiple industry-related standards and laws that regulate user privacy and require very detailed verifications of interactions with users. At the same time, the service should remain simple to use for your customers.

The current laws, regulations, and guidance apply differently, depending on how a financial institution is involved in mobile banking.

For example, financial institutions that let customers access loan services via mobile apps make sure users can access any applicable disclosure requirements. That includes information like the format, content, timing, and the manner of delivery.

Another example: banks that advertise credit-related products are subject to the Fair Housing Act and required to display the Equal Housing Lender logo and legend.

Best-known financial security regulations:

Depending on geographic location and/or under certain special circumstances, your mobile banking app should also comply with an additional set of laws and frameworks, such as EBA, EMV Chip, PCTF, CCPA, FinCen, SOX, FINRA, etc. So, before starting mobile banking development, check what regulations are valid for your target country. If you're making a mobile-only banking app like Revolut, it's a good idea to hire a financial consultant who’ll explain all possible pitfalls.

The banking industry loses $18.37M because of cyber-attacks, which is the highest number among all industries. That's why banking apps come with lots of security features like end-to-end encryption, multi-factor authentication, safe back-end architecture, and so on.

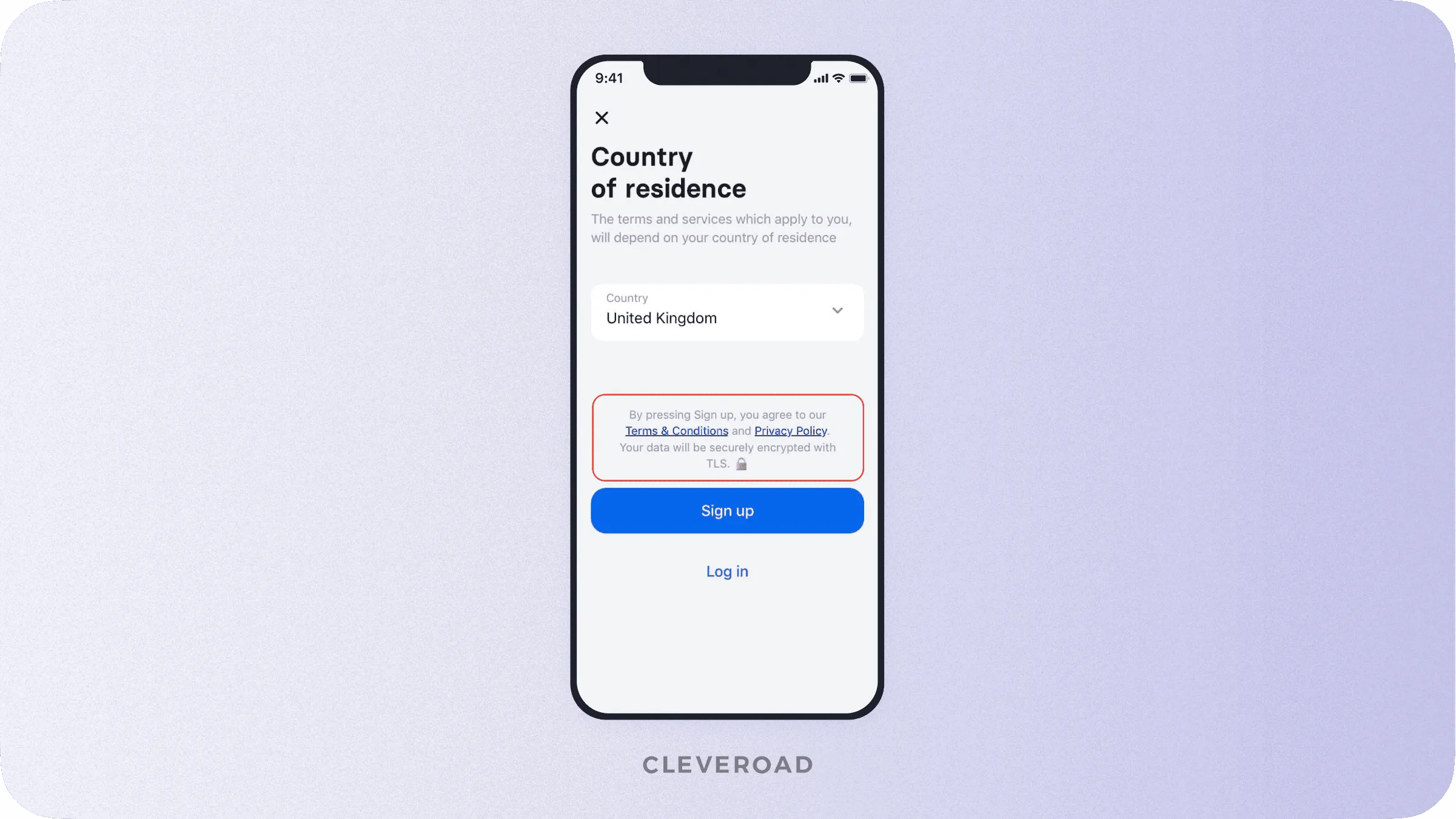

For example, Revolut, a popular British banking app, protects its customers with the Transport Layer Security (TLS) protocol. TLS authenticates everyone involved, checks the integrity of the data being transmitted, and encrypts it at every stage.

Revolut banking apps claims to be TLS-protected

Card details in the Revolut app are stored according to strict PCI DSS regulatory standards. There's a limit on contactless payments, and tons of other security measures that keep users safe.

Biometric login and two-factor authentication (2FA) are must-have security features for banking apps. When it comes to money, every activity—money transfers, payments, purchases—should be additionally confirmed by the user. Besides, people of different ages prefer biometric security features. For example, about 34% of millennials in the United States and the United Kingdom said they wanted biometrics to make transactions more secure. 36% of Gen Xers said the same.

A few other common approaches to secure mobile banking development:

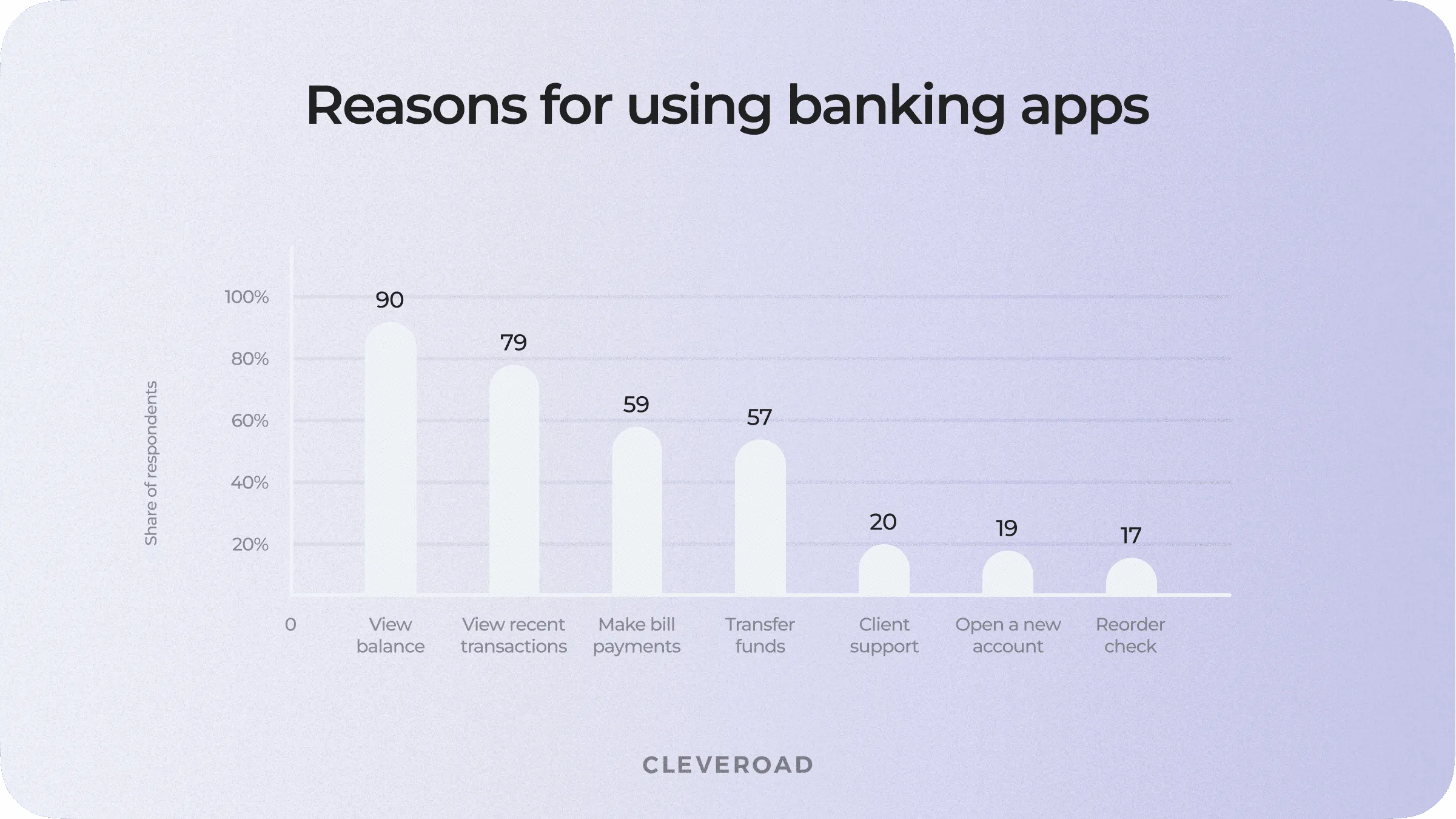

Here are the most common reasons for using mobile banking apps in the United States:

Most popular banking app features in the US (Source: Statista )

But that’s the United States. In your country, the situation might be different.

Before you start mobile banking development, ask your target users about their needs and priorities in operations. Understanding these preferences can also help you estimate the e-wallet app development cost accurately.

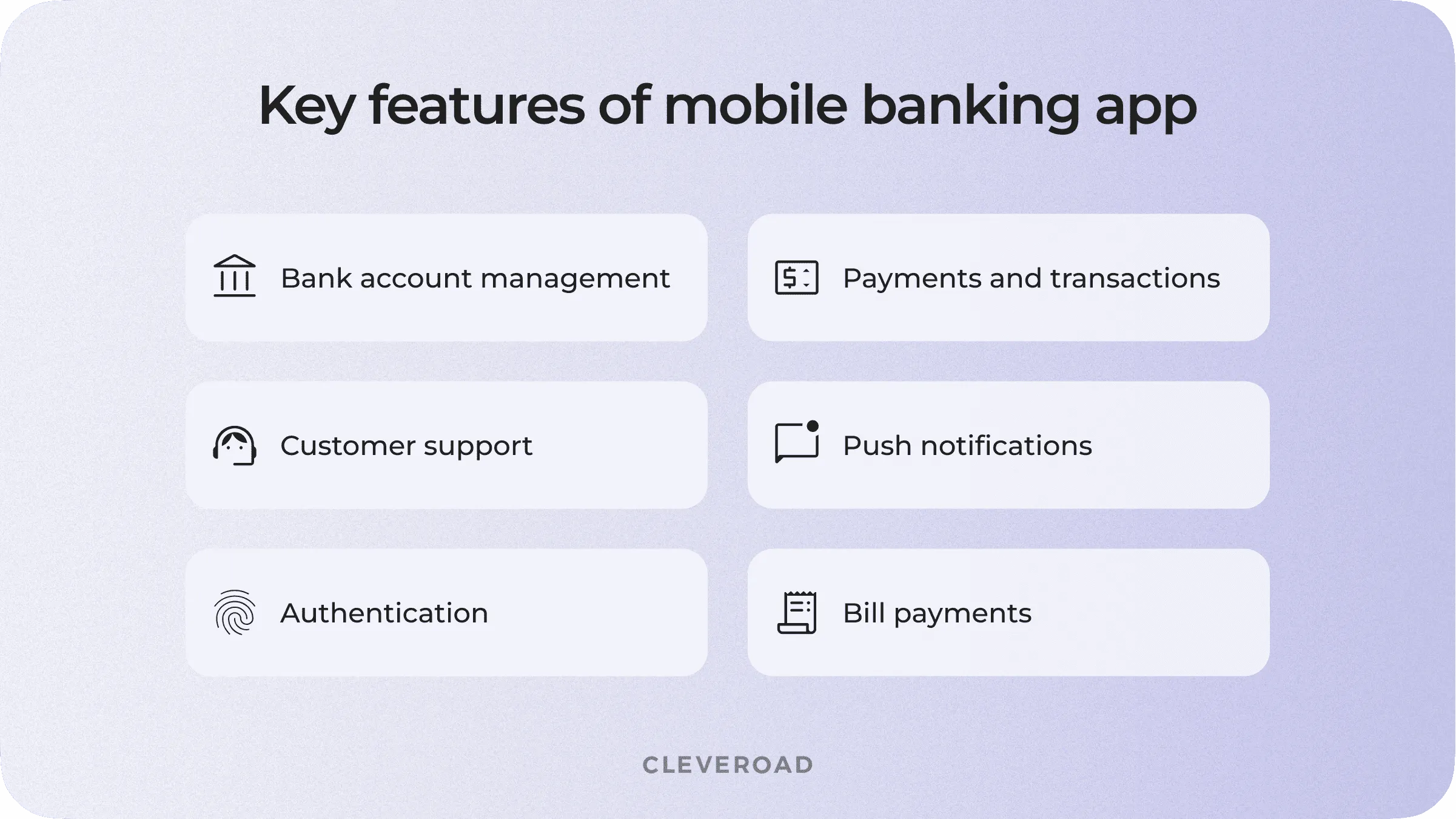

Let’s review the core features most banking apps share:

Nice-to-have features:

The sign-up process depends on the type of your banking app. In case it's a mobile-only bank, users will need to upload documents like their ID card or a passport scan, take a photo with documents in their hands, and so on.

If users have already visited a branch and opened a bank account, they need to sign-in using their mobile number and a password reset option.

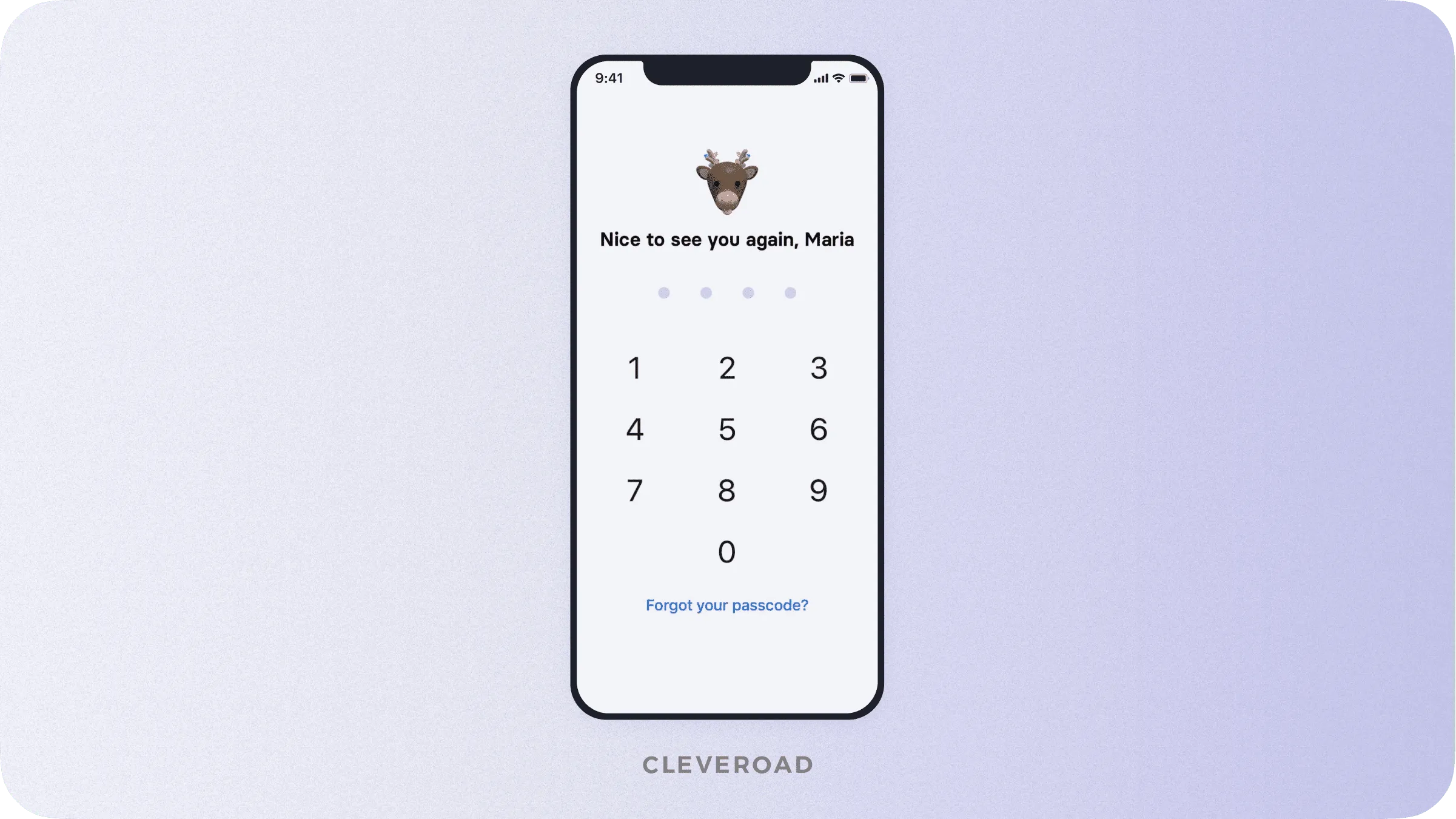

Regular sign-ins should be secure but shouldn’t take too much time. Revolut app asks users to enter a 4-digit passcode, other banking apps either ask to enter a password or use biometric login like Apple Touch ID or Face ID.

Revolut asks users to enter a 4-digit password during login

It may be a good idea to add 2FA verification with codes sent to your device via SMS. It’ll make users feel more secure.

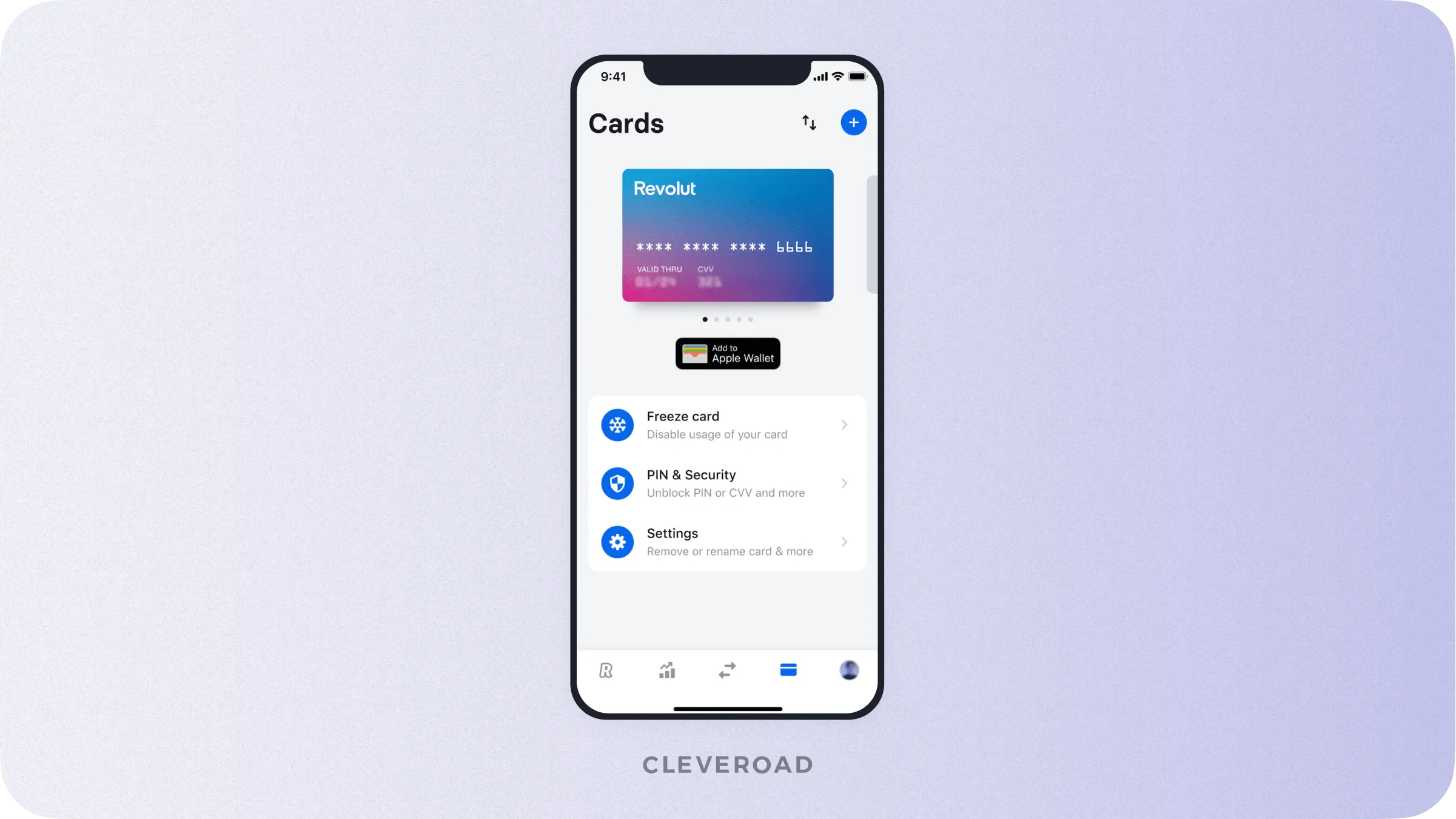

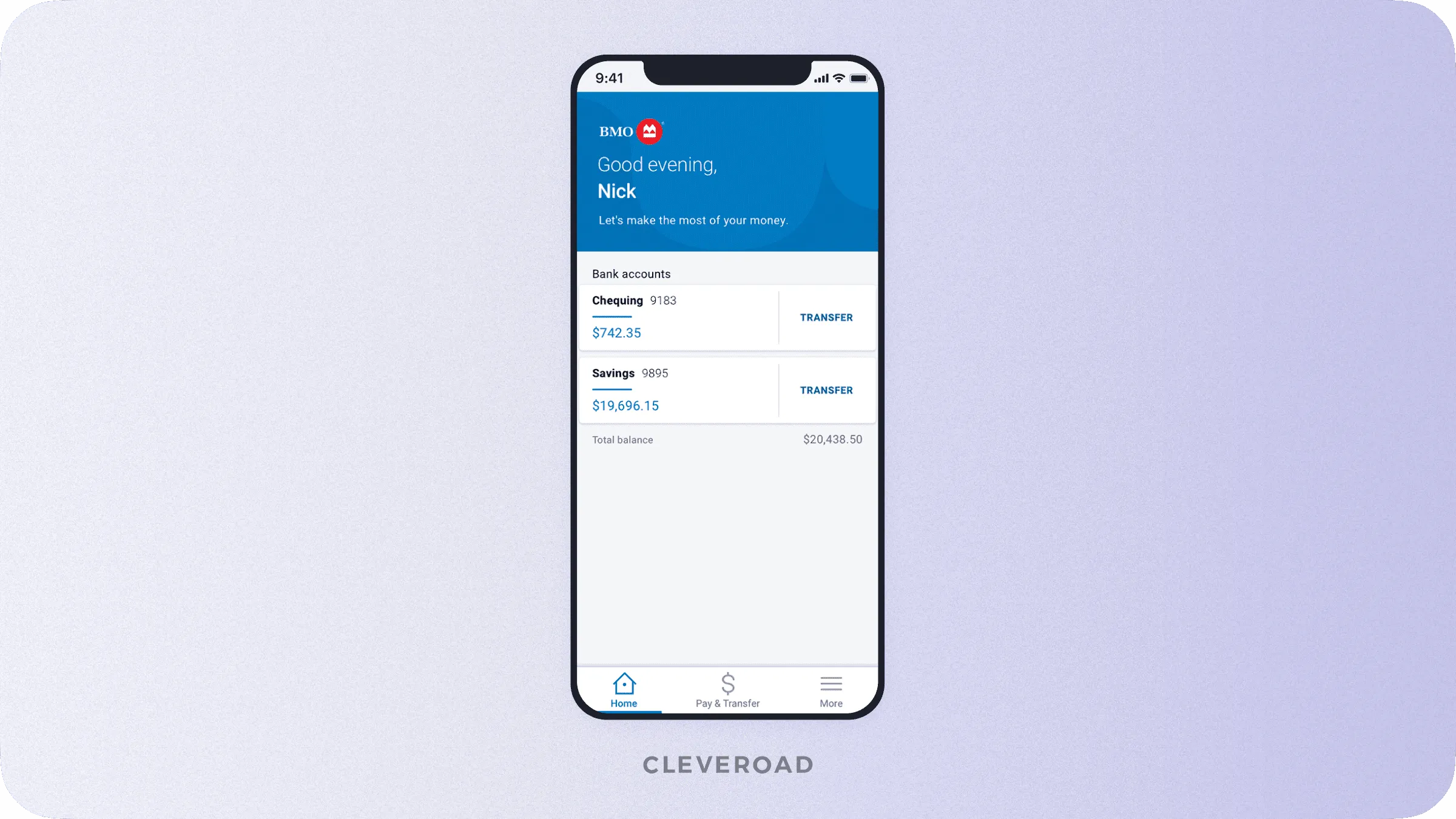

Account management includes a number of banking features: checking cards, viewing account balance and transaction history, managing cards (replenishing, blocking, setting an online payment limit).

The more operations your banking app includes, the more intuitive and minimalistic it should be.

Card management in Revolut

Note! UI/UX design is awfully important on this stage. It’s design that helps you win against your competitors or basically make people want to try out your app.

If users can’t figure out how to manage their cards or view transaction history because of the terrible UX, they’re likely to abandon or delete the app. For a bank that means another lost customer and a bad rate on the App Store or Google Play.

Devastating, especially if your bank is fully mobile.

Sending or receiving money should also be simple and secure as users enter lots of data.

Here's how the process usually goes:

Customers confirm transactions either by biometric verification, an SMS with a code, or by entering their password.

Paying bills offline is time-consuming, inconvenient, and not really secure —checks often get lost or misplaced in the recipient's inbox.

No wonder 59% of mobile banking users in the US prefer to pay their bills online.

Users can schedule one-time or recurring payments in the app or pay when they're alerted by a push notification or an email. For example, if users deal with utility bills and varying amounts, alerts will do fine. While recurring payments are great for fixed amoung like mortgages.

By the way, if there are lots of details or huge forms to fill in, UI/UX designers would probably split this action into smaller steps. This makes the process less scary than filling in a giant form all at once.

Bill payments in a banking mobile app

Banking app development is all about automation, but that doesn’t mean that human aid can be fully skipped. Some operations may require staff assistance or additional verification. For example, when you need to unblock a card or change your credit card limit.

Users should be able to get in touch with a bank representative or a personal manager, ask questions, and get their requests processed.

In case your customer support team isn't available 24/7, you may use an AI-powered chatbot or at least add a FAQ section.

As we've said, reminders and alerts are great for customer engagement and for promoting your services. They can:

As well as they work for security purposes like spotting a fraud the minute it happens.

Key features to add in mobile banking app

We’re done with the basic banking app features, so let’s review the nice-to-haves:

Consider adding an in-app map to help users locate the nearest ATM or bank branches. It’s very helpful when your customers need cash or want to pay your bank a visit.

In-app map with ATM & bank branch locations

Gamification in finances relates to integrating features able to add-on value wrapped into gamified experiences for better customer engagement. Spending and saving trackers and setting financial goals are practical examples of gamification in banking. For example, in Revolut, there’s an option to set limits in the budget to control spendings. The app also helps to calculate the daily limit. Users can track their spends with automatic categorization and the app gives predictions to help users plan ahead.

Spending tracker in Revolut app

Over 27% of respondents in the US and UK had used a QR code as a payment method in 2020.

Still, not many banks offer QR codes for payments which may be a lost opportunity. QR payments are quite secure due to their unique design and easy to set up: users only need a smartphone with a camera and a QR code to read.

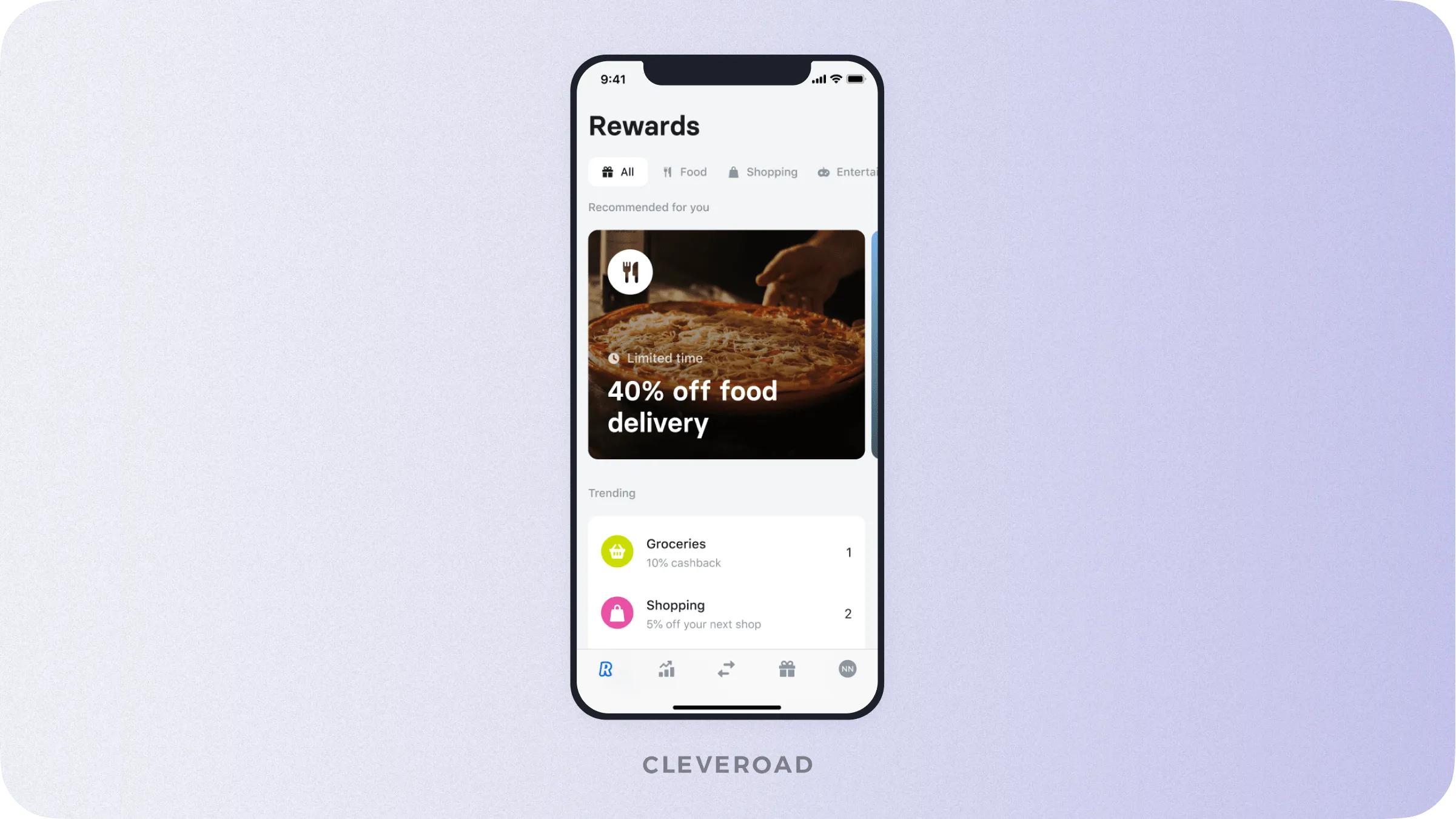

Cashback involves earning a small percentage on the amount customers spend. People love this feature and many banking apps offer automatic cashback on various brands or services like entertainment, groceries, car maintenance.

Revolut offers its users various cashbacks, including groceries

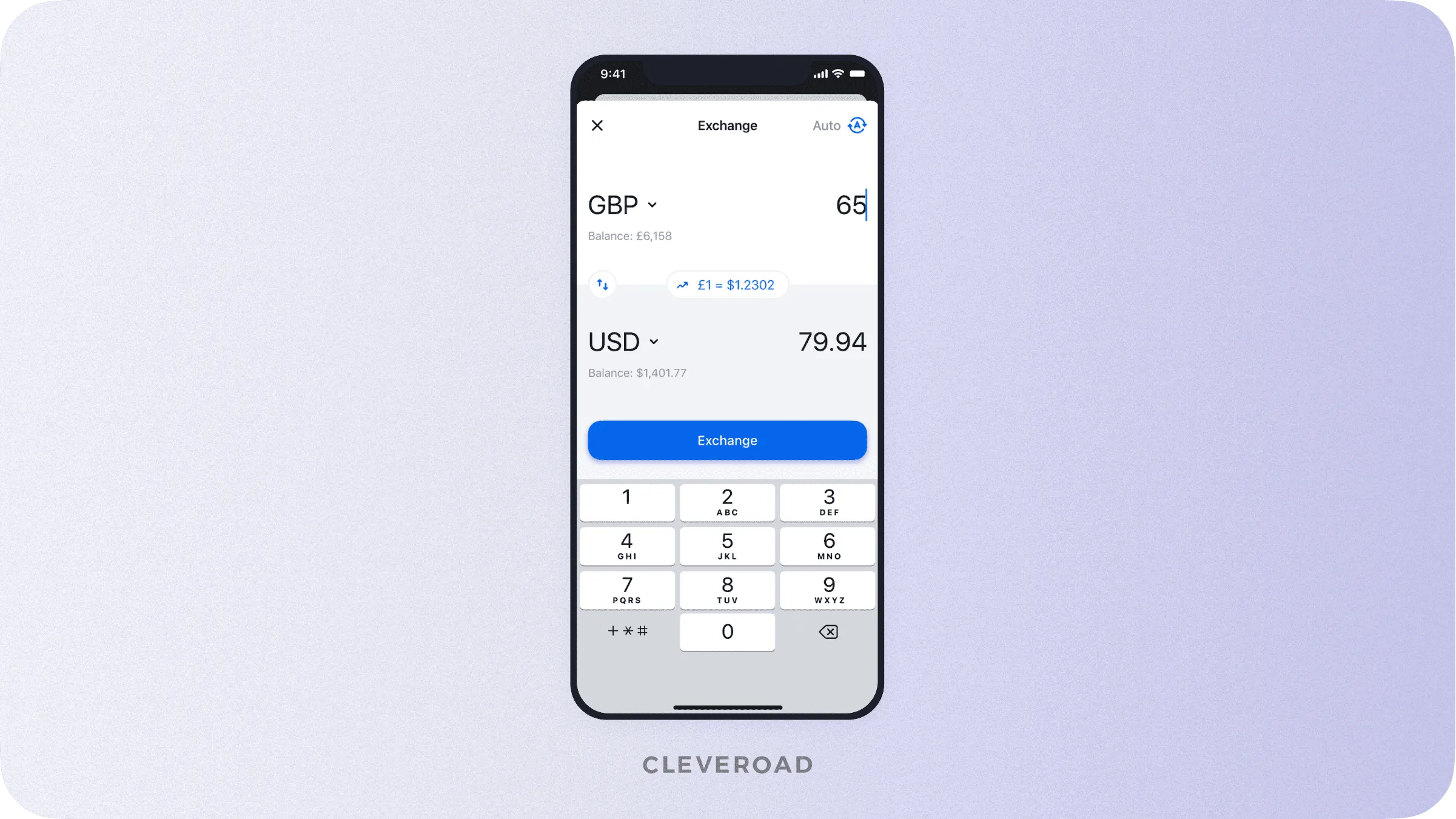

The number of tech-savvy foreign exchange companies is growing fast, and banks need to keep up. Some banking applications only show in-app exchange rates, while others go further and make a fully-fledged in-app converter.

For example, combining multi-currency spending and money transfers in a simple app is what made Revolut app popular.

Revolut has an in-app currency converter

Smartwatches remain the most popular wearable device, but only a few banks make apps for wearables. Offering such may be a competitive advantage.

The Australian Bank of Melbourne was the pioneer in creating a banking app for smartwatches. Customers could pay for goods and services, get push notifications, check their balance, and find the nearest ATM right from their smartwatch.

Example of a banking app for Apple Watch

Finally, let’s see how android banking app development goes in case you’ve decided to cooperate with a third-party vendor.

The first and most crucial step is to find an experienced IT vendor with deep expertise in the banking domain. Moreover, a strong partner must be well-versed in the various payment systems and available financial technologies.

It is also essential to do extensive research and ask for references from past clients. The selected IT partner must be reliable, responsive, and transparent in communication throughout the development process. By choosing the right software development company, , you can be assured that the banking application is developed to the highest standards and meets all your requirements.

Start with market research. Here are some questions to answer:

For example, tech-savvy millennials aren't the only audience of banking apps as you might have thought. 45% of baby boomers (50-60 years) actively use banking apps on their iPads and tablets.

Another example: your banking app may not turn out great if customers need it to pay bills while you’re focusing on debit or credit operations.

Thorough research prevents such situations from happening and saves your money in the future.

If you're working with a If you're working with a mobile banking software development company, they will provide a Business Analyst who could help you with the market research and SWOT analysis. While a solution architect will align business aspects with tech implementation—app architecture, tools, programming languages.

Customers want to use simple and convenient apps with clear navigation and design elements (buttons, icons, and forms).

Still, one of the main issues with banking apps is that users have difficulties understanding the out-of-date designs.

For example, people get mad entering the payment data each time they need to transfer money between accounts. They may also get frustrated or demotivated when seeing huge forms to fill in while paying household bills.

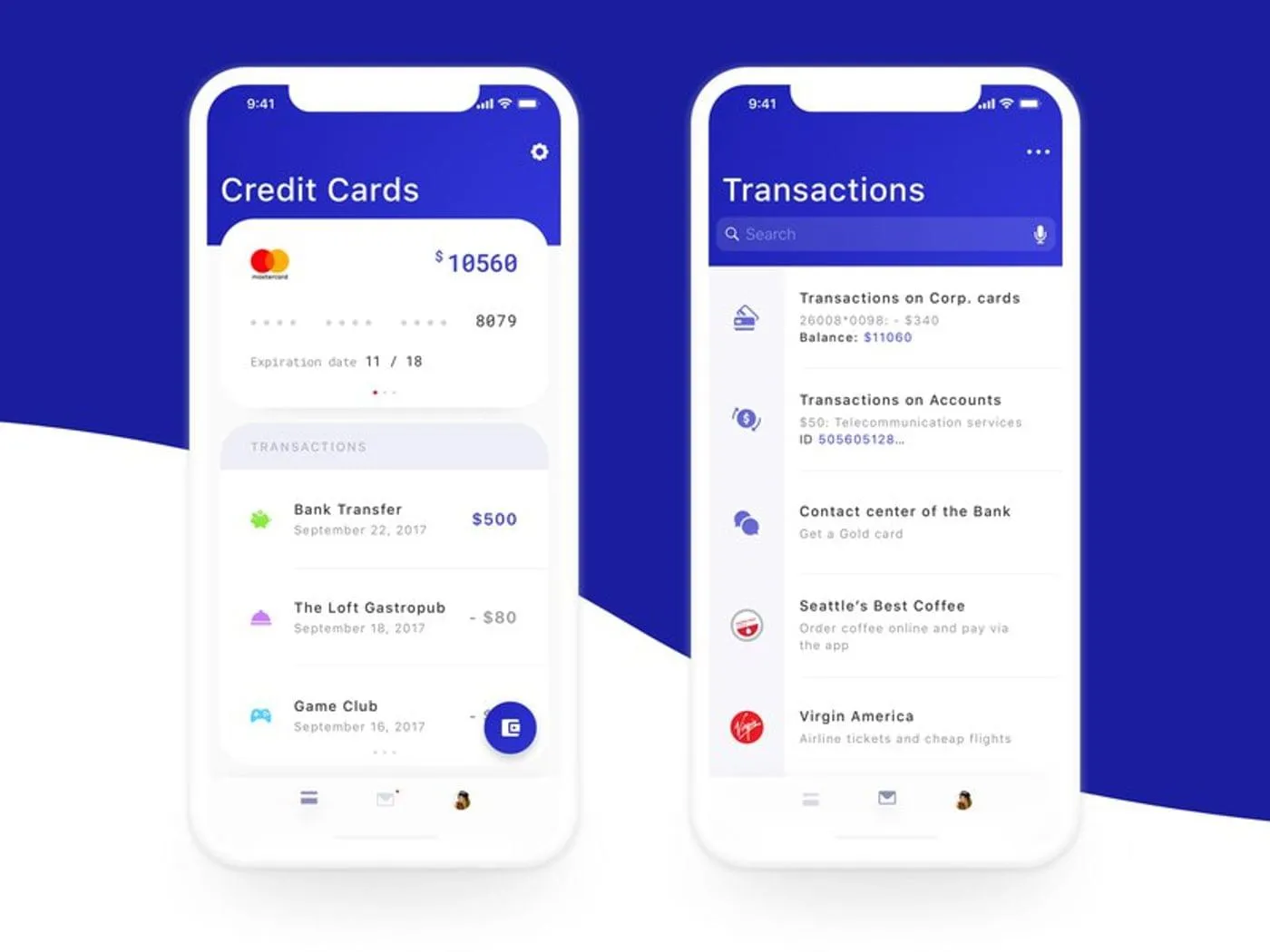

Most development companies start designing the app from low-fidelity wireframes. They show how users can interact with the app and don’t take too much time to create as they’re not detailed.

Example of a mobile banking app design by Cleveroad

Once the team gathers your feedback or gets approval, they start designing the app screen by screen. Including graphics, icons, buttons, and other UI elements.

We've estimated the , including popular Uber and Instagram app.

Here are some banking app designing tips:

For example, Revolut uses colorful illustrations to introduce the app to new customers.

Revolut tutorial for new users

MVP building stands for creating a very basic solution. It helps you to test the market and avoid spending much money on something that may not turn out great.

An MVP is focused on:

Nothing too fancy like gamification, AR/VR technologies, AI-powered chatbots as they take time and money to develop. Only the basic functionality like payments, transactions, account management, push notifications, and a couple of unique features you may want to add.

The choice of the technology stack—programming languages, libraries, APIs—depends on your requirements like the project scope, complexity, scalability.

As you’re making a stance on security, app developers would probably choose native languages—Swift for iOS app and Kotlin for mobile application development for banking. .

Integrating third-party services can significantly enhance the functionality and convenience of your banking app. For example, payment gateways such as PayPal, Stripe, or Braintree allow for secure and seamless transactions, while identity verification tools like Jumio, Onfido, or Veriff ensure user privacy and security. In addition, customer support software such as Zendesk or Freshdesk enables quick and efficient customer support.

However, working with a skilled team experienced in banking apps development is essential to ensure these services' correct and secure integration. Our team of experts is committed to delivering a seamless integration process that enhances your banking app's functionality while providing your users the utmost security and privacy.

Once the mobile banking development is completed, your IT vendor will help you launch it in the app stores. App marketplaces have specific requirements for all apps that get published there. Your app must meet those requirements to get published.

For Apple, it’s App Store Review Guidelines , while for Android— Developer Program Policy and Launch checklist .

But even after your app is published, the work is only beginning.

The first thing to do is to start collecting feedback:

Look through comments on both app marketplaces, use in-app questionnaires, and analyze the user behavior. Notice how users move through the UI, how much time they spend in the app, their click-frequency, and periods of activity.

Once you get the feedback, make a list of weak and strong aspects of your app and, together with your tech vendor, decide on how to make it better.

Let's make a reservation right away that it is difficult to determine the cost of developing a banking app. Each company will have its own rates based on many factors. But on average, the price to make a banking app varies from $160,000-300,000+. It is influenced by different factors, such as:

If the cost seems too high for you, it would be best to outsource the work to optimize expenses. There are many developers in the world, and given development to outsourcing, you can find an "ideal partner" - a company that meets your requirements. The price of creating digital products from companies in Central and North Europe is often lower than in North America or Western Europe.

Separately, it should be noted the flexibility of outsourcing companies. They can quickly and painlessly do the task, and scale the team up and down. It is essential in case of any changes in the task or force majeure.

The outsourcing of app creation is beneficial for the following reasons:

Cost-effectiveness. The price for the work performed on outsourcing has always been lower than that of firms in your country. Being able to cooperate with IT companies worldwide, you can find a partner for the best money value and still get the top quality of the product.

Wide talent pool. There are many talented people worldwide, and outsourcing companies are famous for their vast pool of specialists.

Scalability. Outsourcing organizations can provide scalability benefits by allowing the project to be easily adjusted and expanded to meet changing user demands and business needs without investing additional in-house resources.

Access to expertise and technology. Experience is one of the primary “resources” for developers. It defines the skills and abilities to integrate new features into the application. If you turn to an experienced company, you will surely get a ready-made, functional, and convenient app.

Mobile banking app developer rates in different countries